COVID’S ongoing impacts have shown everyone, including governments, the importance of business events and their direct and more long-term indirect benefits to our communities, our cities and our countries.

The pandemic has also left many of us competing for funding with other competing priorities be they health spend, income assistance programs, infrastructure programs, and more. So, for us to compete in these tough times, we need to be better able to articulate the total benefits of business events to our stakeholders – including our funders.

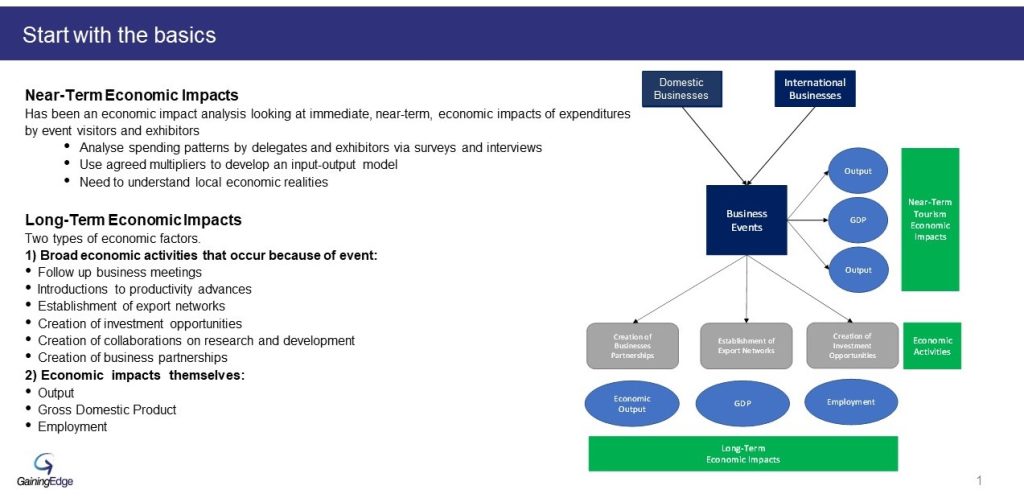

Traditionally, the business case has been, at best, a calculation of the near-term economic impact benefits of an event. This is usually calculated by determining the spend of visitors and organisers via survey and interviews.

In many destinations there are then economic multipliers that can be used to estimate the near-term financial and employment benefit of a business event, usually via an input-output model. These impacts can be estimated at the direct level (so changes that occur in the “front-end” businesses), indirect level (so changes in activity for suppliers of the “front-end” businesses) and the induced level (so spending on goods and services resulting from increases to the payroll of the directly and indirectly affected businesses). Sounds simple right? There are even various websites and calculators that will give you a supposed near-term impact calculation.

However, we find even this relatively simple part of the calculation is often done wrong. Many economic impact calculators, and even many firms that do this, make simple mistakes that your stakeholders could see and then call into question your analysis. Starting with the data capture:

1) it’s a common error to double count the spend of the organising Association with the registration fees paid by attendees;

2) another is the total event attendee and the accompanying person spend is not captured properly, or only includes the spend during the event and not the spend pre and post event, which reduces the actual calculated event impact (not good!);

3) Airfares are often miscounted, with international airfares included when it should only be domestic flights – just a few examples.

Assuming we have the data captured correctly, there are still many other areas we see done incorrectly, especially in those destinations without agreed economic multipliers. This impact analysis is not a one-size fits all. It needs to take account of local economic realities and if we don’t have robust multipliers then we need to look for similar markets as comparison and adjust those based on our local market understanding.

Without all of this, our analysis is, at best, inaccurate and, at worst, wrong. And our ever more sophisticated stakeholders and funders will see right through this.

So that was the easy part, right? And that may have been all that was needed before. But more and more we’re seeing destinations need a more robust, and convincing, business case that will also look at the long-term economic impacts, and the legacy impacts, of an event. These types of impacts may only be realised years in the future.

The identification and quantification of long-term economic impacts is much more complicated and involves two types of economic factors:

- The first type of factor consists of broad economic activities that occur because of the event. These activities may be wide in scope and may be tangible or intangible in nature, such as follow up meetings, new investment opportunities, new export routes opened, or new business partnerships. These activities are not economic impacts but are intermediaries that lead to the creation of long-term economic impacts. So, we need to identify and measure them to allow us to quantify the long-term economic impacts.

- The second type of factor is the long-term economic impacts themselves. The most common measures used in quantifying long-term economic impacts are: 1) output (the total gross value of goods and services produced); 2) GDP, or value added, the additional value of a good or service over the cost of producing it; and 3) employment, the number of additional jobs created.

These are the factors that are going to get the attention of other parts of government, those looking at economic development, job creation, generally those areas of government with ultimate control of the purse strings and with bigger budgets… but estimating the long-term economic impact requires us to understand exactly WHICH economic activities will create the economic impact and be able to measure them. And this has seldom been done for events.

This brings us to what a Better Business Case can be, which is much more than only the Near-Term economic impacts. A Better Business Case will also look at, the long-term economic impacts… which are in fact part of what makes up the Legacy Impact(s) of an event. A Better Business Case will also be further justifying the event via also looking at what are the desired meeting outcomes (which are Legacy Drivers), from which we are now able (through GE’s work on Legacy Impacts) to build a narrative around the additional long-term Legacy benefits, or impacts, of an event.

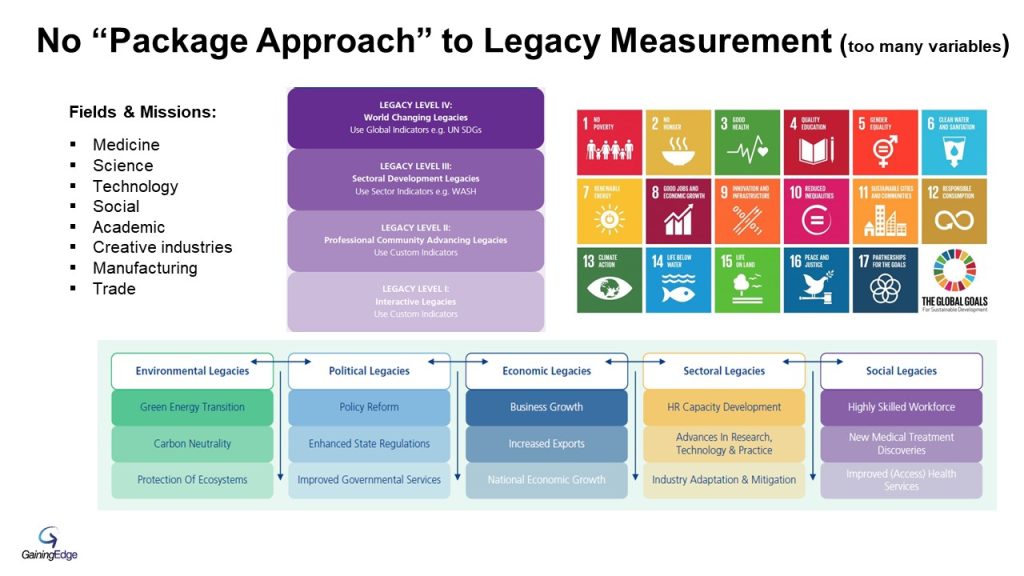

Some of these Legacy Impacts are provided on the above table, and they can range from improved exports, to improved health outcomes, to improved social outcomes, to increased investment or talent attraction… among many others. These are outcomes and legacy impacts that are far beyond the traditional for tourism and business events. These Legacies can be powerful motivators across a myriad of stakeholders and, importantly, open up new funding sources.

Unlike the economic impact assessment where we have generally accepted models and principles, the approach to Legacy is much more varied because there are more variables around event types and sectors. But there is now an accepted framework for how to categorise and measure.

Each type of event can have environmental, political, obviously economic, sectoral and social legacies. These legacies can occur at four levels:

1) The more personal, around knowledge sharing;

2) the Professional Community;

3) at the Sectoral Level; and…

4) what we call world changing legacies, such as of the type described by the UN SDGs. The type of legacies, and the levels they attain, are bespoke to each event and so can be their measurement. But if the work is done upfront in the business case, these can be identified, measured, and via this process their impact can even be increased.

If the business case also provides for a system and means of measurement of economic and legacy impacts – we will then have additional retrospective data and justification for the event. So the next event proposed will then have an even stronger, better business case. This Better Business Case will not only serve as a rational justification of the event before it occurs, it will put in place a system and process to justify the event after the event has happened… and further the business cases of future events.

And that, is a Better Business Case!

Jon Siverston is CEO of business events consultancy GainingEdge. He is a specialist in Public Private Partnership (PPP) projects

Main picture: One of the conference sessions at the recent IBTM Barcelona