ASIA’S exhibition industry is gearing up for a year of contrasts, according to the latest UFI Global Exhibition Barometer.

While markets such as Malaysia and Thailand are primed for vigorous expansion, others – including China – are bracing for steadier conditions, underscoring a region moving at markedly different speeds.

The findings, drawn from a survey concluded in December 2025, offer one of the clearest snapshots yet of how the sector is reshaping itself in the post‑pandemic era.

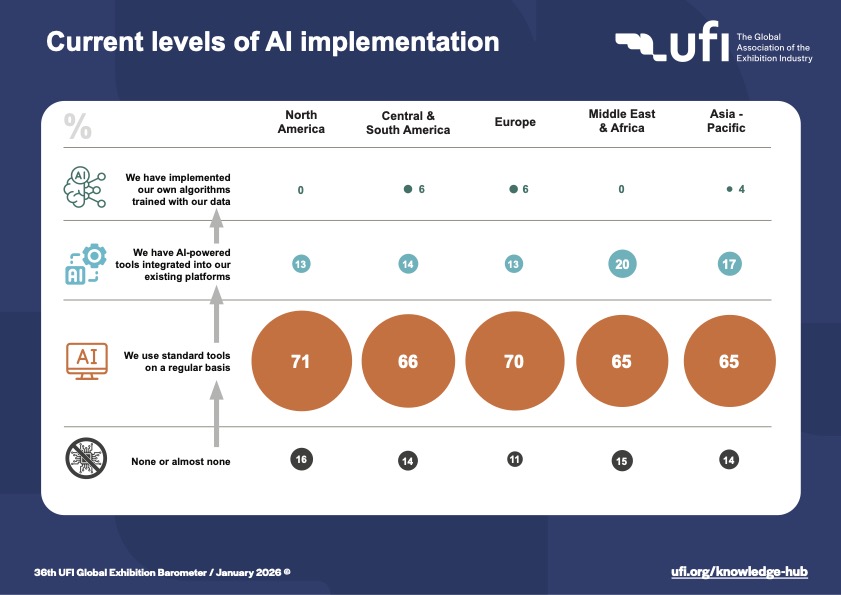

UFI Managing Director and CEO Chris Skeith said the overall results “confirm what we are seeing across the industry: strong, steady growth and a sector that continues to adapt at pace”, noting in particular the “solid growth in rented space and operating profits across many markets, alongside a notable acceleration in the use of AI to improve efficiency and customer experience.”

Below is a breakdown of the 36th UFI Global Exhibition Barometer findings for China and markets in Southeast Asia that stood out in the report for the changes business event organisers expect and are delivering.

Chinese Mainland

China stands out as the only Asia-Pacific market where a majority of respondents – more than six in ten – expected activity to remain stable, rather than rise by more than 5 per cent. This places China in contrast with its regional peers, which foresee stronger year‑on‑year expansion.

The steadiness suggests a period of consolidation rather than decline, according to the report, reflecting more cautious sentiment among local exhibition organisers and venues.

Malaysia

Malaysia is highlighted as one of the strong performers in the Barometer’s Asia-Pacific analysis. It is among the four out of five regional markets that expected more than 5 per cent growth in 2025.

Malaysia also emerges as a regional leader in AI adoption. According to the report, 28 per cent of Malaysian companies surveyed have either integrated AI‑powered tools into their systems or developed proprietary AI algorithms, placing the country among the most technologically advanced exhibition markets globally.

Thailand

Thailand is another of the region’s standout markets, also forecasting growth exceeding 5 per cent for 2025.

The country ranks even higher than Malaysia in advanced AI deployment: 31 per cent of respondents report having either integrated AI‑powered tools or implemented in‑house AI systems. Thailand also appears among the world’s top markets for using AI to generate new revenue streams, with 33 per cent of companies reporting testing or implementation in this area.

UFI chief executive Skeith said that despite differing national outlooks, the broader sector is entering a period of confident expansion. “This edition of the Global Exhibition Barometer confirms what we are seeing across the industry: strong, steady growth and a sector that continues to adapt at pace,” he said, adding that the “call for more engaging and interactive event formats highlights the industry’s ongoing focus on enhancing value for participants.”

Across Asia, the 36th Barometer underscores a dual‑track recovery: buoyant growth and aggressive digital adoption in markets such as Malaysia and Thailand, paired with more measured expectations in China.

Main picture… Attendees at the Canton Fair in Guangzhou